Bangladesh inks $2.25 billion loan agreement with World Bank

The World Bank is set to provide $2.25 billion as a loan to Bangladesh to develop various sectors, including regional trade and connectivity, disaster preparedness and environmental management.

Sharifa Khan, secretary of the Economic Relations Division (ERD) and Abdoulaye Seck, Country Director, World Bank in Bangladesh signed the agreements on behalf of their respective sides.

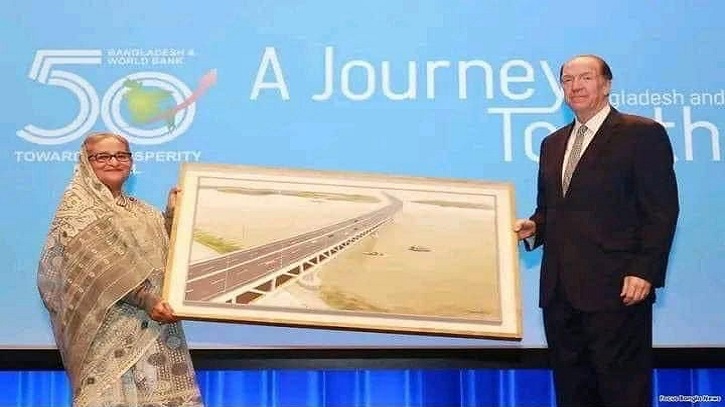

According to a press release issued by the Ministry of Finance, Prime Minister Sheikh Hasina and World Bank President David Malpass were present during the exchanges of the financing agreement.

This loan agreement comprises five projects:

The $753.45 million Accelerating transport and trade connectivity in Eastern South Asia (ACCESS) – Bangladesh Phase-1 Project

The objective of this umbrella project is to develop efficient and resilient regional trade and transport in Bangladesh. The implementing agencies are National Board of Revenue (NBR), Roads and Highways Department (RHD) and Bangladesh Land Port Authority. The project will be implemented in July 2022 to June 2028.

The $500 million Resilient Infrastructure Building Project (RIVER)

The objective of this project is to reduce the vulnerability of the population across the cyclone and flood prone coastal districts of Bangladesh. Another objective is to provide safe shelter to human being and their resources including livestock during natural calamities like cyclones, tidal surges and flood. Local Government Engineering Department (LGED) of Local Government Division (LGD) will implement this project in 6 (six) years (01 July 2022- 30 June 2028).

The $500 million First Bangladesh Green and Climate Resilient Development (GCRD) project

The main objective of this budget support program is to support the Government of Bangladesh for transitioning to green and climate resilient development by (i) enhancing public planning, financing, and delivery of green and climate resilient interventions; and (ii) promoting key sector reforms for greener and more efficient production and services. Finance Division is the main implementing agency for this program. This budget support will be released by 30 June 2024 subject to compliance of certain prior conditions.

The $250 million Sustainable Microenterprise and Resilient Transformation (SMART) project

The objective of this project is to increase resource-efficient and resilient green growth of microenterprises (MEs) in Bangladesh. The project aims to promote and transform the microenterprise sector into a more dynamic, lower polluting, resource-efficient, and climate resilient sector. It will be implemented by Palli Karma-Sahayak Foundation (PKSF) during the period 2023 to 2028.

The $250 million Bangladesh Environmental Sustainability and Transformation (BEST) project

The objective of this project is to strengthen the capacity of the Government of Bangladesh in environmental management and to reduce pollution discharges. Implementing agencies of this project are Department of Environment (DOE) (Lead Agency), Bangladesh Road Transport Authority (BRTA), Bangladesh Bank, Bangladesh High-tech Park Authority (BHTPA). The project will be implemented in five (05) years (July 2023 to June 2028)

Terms and Conditions

Bangladesh is getting 4 (four) loans (out of 5) from regular IDA. Only First Bangladesh Green and Climate Resilient Development (GCRD) has two types of credit-Regular IDA ($176 million) and Short-term maturity loan ($324 million). Regular IDA loans are to be repaid in 30 (thirty) years with a grace period of 5 (five) years.

A service charge of 0.75% per annum and interest at the rate of 1.25% shall be paid on the withdrawn amount of this loan.

Besides, a maximum annual commitment fee of 0.50% is payable on the unwithdrawn financing balance. It should be noted that the commitment fee has been waived by the World Bank for Bangladesh for a long time including the current financial year.

On the other hand, Short-term Maturity Loan (SML) has to be repaid in 12 (times) years with a grace period of 6 (six) years.

No service charge and interest will be applicable on the withdrawn amount of this loan.

Since 1972, the World Bank has been one of the main development partners of Bangladesh.

World Bank has committed a total of $40.4 billion in loan assistance and $722 million in grants for Bangladesh under 368 projects/programs till now.

//M//